7 best income generating assets for passive income

In times past, we talked about 21 passive income ideas for a freedom lifestyle.

I introduced you to a variety of passive income ideas and we explored them by qualities such as risk, return, effort, money, and liquidity.

This helped to paint a picture of what these ideas are about from the basket of available passive income ideas.

It even helped us to rank them by a score to make choosing which to consider investing in a lot easier.

Today we are going to explore why these matter and how they help you do something very important – do the heavy lifting.

To start from the basics. The official definition goes something like this:

An asset is a source of future economic benefit.

I really like this definition because it gives clues about who assets are for. They exist to help those who are future-minded achieve their goals.

In even simpler terms, assets exist to put money in your pocket today and tomorrow.

But which assets should you really invest in for passive income and why?

The Pareto Principle (80/20 rule) or the law of the vital few states that, for many events, roughly 80% of the effects come from 20% of the causes.

For example, in business, we know that roughly 80% of the sales come from 20% of clients.

80% of the income from football games come from 20% of the super fans.

You see this in churches – 80% of the donations come from 20% of the attendees.

I see this even with this blog. 80% of the traffic comes from 20% of the blog posts.

What we are looking at with the 80/20 rule is somewhat a law of nature. It applies to most things but not everything.

Imagine what would happen if we used our knowledge of this principle to commit our resources to the 20%.

Think about that for a moment.

How is the 80/20 rule working in your life right now?

Bringing this back to our topic of today.

I’d argue that 80% of your passive income will come from 20% of your income generating assets.

The question then becomes, which of the income generating assets could be your 20%?

Here is an even more important implication of the 80/20 rule:

If 80% of your passive income does come from 20% of your income generating assets, then it follows mathematically that:

64% of the passive income comes from 4% of the income producing assets.

Or

51% of the passive income comes from 0.8% of the income producing assets.

In simple terms, circa 50% of your passive income comes from circa 1% of your income generating assets.

Note: For Maths buffs, 64% comes from 80% x 80%. 51% comes from 80% x 80% x 80%. 4% comes from 20% x 20%. 0.8% comes from 20% x 20% x 20%. The 80/20 rule is fractal. It applies to a population of 1,000,000 as it would to a population of 10.

Before we dive into these assets, let us first state more plainly why we even need them at all:

Heavy Lifting

Income generating assets exist to help you do the heavy lifting.

If you think about it, most rich people you know do two things:

(A) They delegate to people,

(B) And they delegate to things.

For (A), they simply let other people do the activities that aren’t necessarily value adding to them. E.g. Cleaning, mowing the lawn, food shopping etc.

And then for (B), they delegate the task of making money to things such as assets. They know that assets will more reliably create wealth over time than labour.

For you and me given our limited resources, it means that we have to be very particular about what assets we invest in to do our heavy lifting.

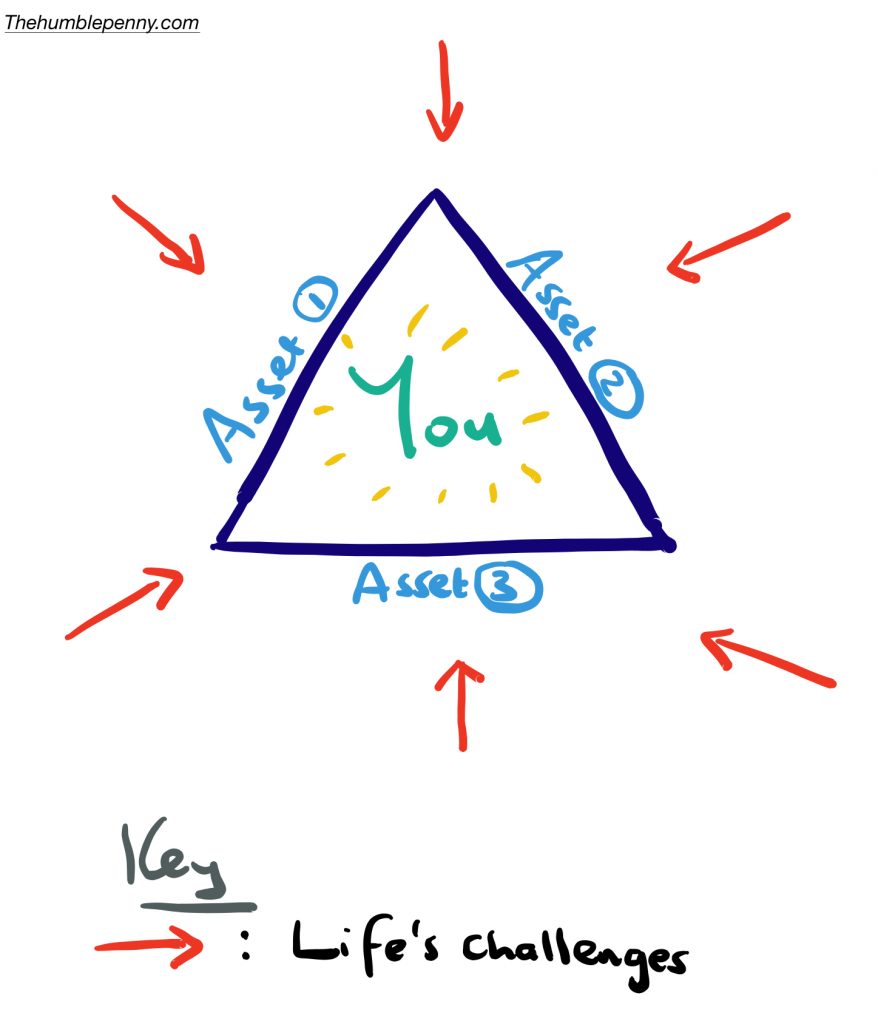

In my mind, I see something like this:

The 3 assets I’ve highlighted above essentially play the role of doing the heavy lifting and protecting you from life’s challenges aka expenses.

These income generating assets could be considered your “Generals”, with the goal of protecting you (the key asset).

In everyday life, if these assets do their work well, then you’ll live a life of bliss. Well, most of the time.

Achieve Financial Independence

Income generating assets are critical if your goal is to achieve Financial Independence.

This is because they’ll get you to financial independence quicker and best of all, keep you there.

In case you’re new to this idea, what you need is for the income from your assets to exceed your expenses.

Although this might seem like an impossible task compared to where you are today, it is possible with a plan and much action over time.

Optimising your life for freedom and independence begins by first choosing it in your mind as a goal.

Increase Net Worth

Income generating assets help you strengthen your financial position and increase your net worth.

This is a particular case in point re the 80/20 rule.

You’ll find that most people with high net worths usually have a big portion of it tied to properties, for example.

Life Design

Income generating assets help you bend time to your advantage.

You can literally create the type of lifestyle you want and go against the grain of the masses.

Do you want to live 6 months in Australia and another 6 months in Europe? Or Africa?

Or do you want to work 3 days a week and have 4 days off to do life how you want?

Income producing assets make that a possibility.

Generational Wealth

When I walk down certain posh streets in London, I often look at the beautiful properties and the people coming out of them.

The one question I always ask myself is – How on earth did they buy that property?

Even though I’d like to believe they worked really hard to get there, the truth is that the majority of such people inherited:

- Either the properties, or

- The money to buy the properties

I haven’t had the priviledge of inheriting anything yet, which in many ways is a huge motivation for me to find a way to break through.

This might be your situation too as I’m well aware that only a handful of people really inherit anything from their parents as legacy has stopped being an important word.

Investing in income generating assets is one way to change the game not just for yourself, but for those that will follow you.

I see this in my life today as a dad. It’s not just the assets that will get passed on to my sons, more importantly it is the knowledge of how to create wealth.

Now that we know why this is important, let us dive in and explore 7 best income generating assets for passive income today.

More importantly, I’d like you to understand exactly how they work to do the heavy lifting for you.

Best Income Generating Assets

It is worth making clear that whilst these income producing assets have a passive element to them, they’re not all 100% passive.

1. Property Investing

This involves investing in physical units of property usually in a variety of locations (chosen based on an investment case).

There are a variety of strategies for investing in physical property units. Two popular ones are:

- Buy-to-Let – standard investment in single units with lettings to a family, couple etc.

- House of Multiple Occupancy (HMO) – Letting to multiple parties in often self-contained rooms.

Property investing has huge appeal because many people feel they understand it.

If you’ve lived in a house before, it’s easy to feel like you understand how to buy and to let a house out.

One of the biggest mistakes with property investing is buying at the wrong location.

This is often compounded without an investment case for buying and made worse with no idea of how the property actually ties into one’s overall asset allocation.

The other big mistake is underestimating the true cost of property investing.

These include taxes, voids, maintenance, court fees, agency fees, stamp duty, legal fees.

Then ofcourse you throw in possible heartache and opportunity cost.

The thing is though, if you take the time to understand how this really works and how to mitigate your risks (e.g. via insurance and outsourcing), then this asset class could be a winner.

In fact, if you get it right, you’ll be looking at significant wealth creation over time potentially.

But don’t underestimate the risks involved, including regulatory risks tied to government rule changes over time.

The actual income generating asset: Physical units of property

Passive income from: Recurring rental income and wealth through property capital appreciation.

My personal thoughts: I have a bit of a love-hate relationship with property.

It’s an important asset class for portfolio diversification and great for generating cash flow.

It has served me well (thanks to leverage) but I’ve also felt pain.

Rental income is more guaranteed than dividend income, although with risks, illiquidity, and costs naturally.

How to get involved: Invest savings built-up over time as a deposit, or free up equity from an existing property.

Alternatively, a joint venture with someone else and pool funds. The goal here is to use as much bank lending as you can get to finance the purchase.

Related post: Investment Asset Classes: Pros & Cons

2. Short-term Rentals

Here you’re typically using your home and renting a room out, or you’re using an entire property.

Depending on where you live, this could be a very good way to make passive income.

What’s particularly interesting about this is that short-term rentals are usually more profitable than long-term lets, and often at low risk.

You do have the burden of maintenance, which can be outsourced, making this a worthy investment to explore.

The actual income generating asset: Your home or property unit.

Passive income from: Rental income.

My personal thoughts: This is a no brainer if you have a spare room. It turns your possibly mortgaged home into a true asset.

How to get involved: Use existing space and explore platforms such as Airbnb or Gumtree.

3. Basic Boring Businesses

Here we are talking about everyday businesses that we interact with in our day to day lives.

Whether it’s a coffee shop, dry cleaning business, franchises, ice cream joint, you’re essentially investing in something that follows a similar pattern to our other assets.

Similar to investing in public listed companies (directly or via funds), you’re also investing in a business but this time doing it alone or via a joint venture.

The goal ultimately is to get other people (helped by technology) running your business for you.

See 85 Ways To Make Extra Money for some practical ideas.

The actual income generating asset: A boring but real business that you have the majority of the equity in and likely control (>50% ownership).

Passive income from: Dividends paid out of Retained Earnings.

My personal thoughts: The rules are set up for business owners to do better than employees over time.

Do whatever you can to own a good business, although remember that when you invest through the stock market, you immediately become a business owner.

How to get involved: You can either create a business from scratch or buy one! You can even start a business with no money.

4. Index Funds and ETFs

With index funds and Exchange Traded Funds (ETFs), you’re investing through the stock market via a passive investing strategy.

This is the strategy I recommend if you want to create long term wealth over time.

The index fund or ETF has one primary role of tracking an index (list of companies) as accurately as possible, in order to generate the return of that index.

It works via partial or full replication of the index, with the latter as the preferred.

The secondary role of the index fund or ETF is to give you diversification by reducing the specific risk tied to companies.

One notable difference between index funds and ETFs is that the latter is traded on a stock exchange like a stock.

The actual income generating asset: Underlying companies on the index.

Passive income from: Dividends paid, which if reinvested compound over time. You also get capital gains from price changes over time.

My personal thoughts: If you aren’t already investing in these, get onto them today! But only do it if you have goals set, and you understand your time horizon and attitude to risk.

Another subtle point to make is that it is the fastest way for you to become a business owner. Potentially the owner of thousands of businesses.

How to get involved: Before you act, you must first understand. Follow the link below, and read related posts.

Related post: Index Fund Investing and The Simple Path to Wealth

Then look up innovators such as ‘Vanguard’ who have made things very easy for you and me. Other providers exist also such as ‘iShares’.

You can also open accounts with the likes of ‘The Share Centre’ or ‘Hargreaves Lansdown’.

Whatever you do, don’t rush into it. It will matter for your future wealth to fully understand what you’re doing.

For easy to understand deep learning via tailored video content, see Stage 7 of FIRE SuperPower™ curriculum.

NEW: We recently made a Video on our YouTube Channel about 9 BEST Passive Income Ideas:

5. Peer-to-Peer Lending

So far, we’ve talked mostly about investing in equity related assets of some sort or another.

With P2P, what you’re really doing is lending money for a return.

That money is then invested in various assets (such as property development projects) that carry some risk.

Ratesetter and The House Crowd are examples of platforms that allow you to do this straight from your smartphone.

The actual income generating asset: A debtor balance on your balance sheet.

Passive income from: Fixed interest over a specific term.

My personal thoughts: This sits somewhere between leaving money in cash and investing in individual stocks in terms of risk.

As it is not equity investing, you don’t expect to lose your principal.

How to get involved: Check out RateSetter, for example. Not a personal recommendation.

Also, feel free to read our Peer-to-peer lending guide.

6. Real Estate Investment Trusts (REITs)

This is a way of investing in property but without the hassle of owning a physical unit or dealing with tenants.

In a way, a REIT is similar to an ETF because it can be traded on a stock exchange.

The REIT is a company which you invest in, and it then invests, owns and manages property assets.

In the same that you become a business owner via investing in Index Funds and ETFs, you’re also a landlord automatically by investing in REITs.

Some of the UK’s largest property companies are REITs, for example, ‘British Land’ and ‘Land Securities’.

The actual income generating asset: A company on the stock exchange.

Passive income from: Dividends. REITs have to distribute >90% of its earnings to shareholders.

My personal thoughts: REITs take on a lot of debt because they have to pay out over 90% of their earnings. This is worth keeping an eye on in relation to the Net Asset Value (NAV)

How to get involved: Open a dealing account and get started. First, learn more here.

7. Websites

In the old world, websites existed mainly to give basic information about a business.

Today though, websites fulfill a totally different function and are themselves the business for most companies.

Most of us now make our purchases online as consumers and this trend won’t change anytime soon.

As an investor, you can invest in either creating a website with value or buying an existing one.

Starting a money making blog, for example, has become a major thing thanks to low start-up costs and ease of technology acquisition.

You know something is pretty serious when you can find a readily available market for it.

Websites such as Flippa, Empire Flippers and FE International exist to help you buy or sell a website.

Note that it is not just creating a website that matters. It is really more about the business of the website.

The website is merely a vehicle that delivers value (i.e. does the business).

The actual income generating asset: The website and related intellectual property, trademark, customer lists.

Passive income from: Ad revenue, recurring affiliate income, memberships, proprietary digital products etc.

You then have the option of selling your website one day if it is profitable. Typical multiples are for 3 times EBITDA.

My personal thoughts: This is something anyone can do with little money and with potential for high returns over time.

Although you can benefit from the effects of compounding with a blog, compared to Index Funds & ETFs, running a website requires your time commitment in one way or another.

There is also a learning curve but one that benefits you more in the growing digital world.

Finally, do it not just for money. Do it because you will truly do the work to add value to others.

How to get involved: Follow this link to create your blog cheaply or google some of the companies above and see what’s for sale.

In conclusion, although the choice of income generating assets you make matters, the key is to get investing in something without the overwhelm.

Even with £100 a month, you can get involved with most asset classes above from equities to property investing.

You can become a business owner even with that amount of money.

With access to the knowledge you now have, put aside the hype around you and make sure you ask the hard questions.

Your future wealth and potentially that of others you love has everything to do with the decisions you make.

Related posts:

- How to Start Building Passive Income for Financial Independence

- Why Saving Money Should Be Prioritised Over Investing

- 10 Tips For Smarter Investing

- How Index Trackers Work To Make You Rich

What income generating assets have you invested in for some passive income?

Do please share this post if you found it useful, and remember, in all things be thankful and Seek Joy.