Like you, I have started the year with ambitious goals, and one area we’ll all have in common are our finances.

Love it or hate it, money has a role to play in all aspects of our lives in the present and the future.

Given many of us will likely have at least one retirement in our life times, the subject of sowing seeds for tomorrow become ever more important.

Good seasons should mean we borrow from those seasons and plant for future guaranteed bad seasons.

With many of us seeking Financial Independence and Early Retirement, I can’t help but keep it real and say that we can’t consume however we want today and expect those goals to magically become a reality.

As I write to you, I am on a train journey and staring at the changing landscapes outside.

Such is life, today things look good, tomorrow they could look better or entirely worse.

And as much I am aware that I can’t control every aspect of my present and future life, there are certainly many things I am actually responsible for.

One of those is the decision on how I allocate my money between essential and non-essentials in order to better guarantee my near future goal of Financial Independence.

As I reflect on this train ride to some good music, below are some non-essentials that are holding your future hostage –

1. Television

I have a love hate relationship with TV. More recently it has been more of the latter than the former.

TV affects your future in two ways –

a. Time – if you spend and hour or more every day watching TV, then I am sorry to tell you that those dreams you have will remain dreams.

TV doesn’t just rob you of the time commitment but also the opportunity cost of that time wasted.

b. Expensive TV packages – Sky, HBO, Netflix etc are not must haves. Just because it appears normal to have these things does not mean you should.

The worst part is, there are many people out there paying for one or two of these packages at the same time and then committing time to consume the content in order to feel good about themselves.

The above is the possible worst case scenario as you’re being hit by a double whammy.

Let me make this real –

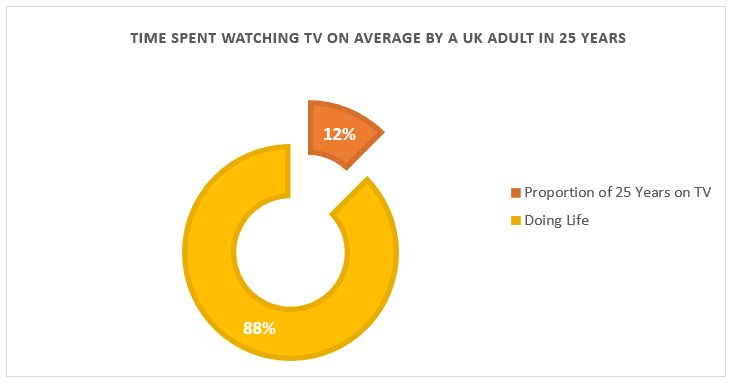

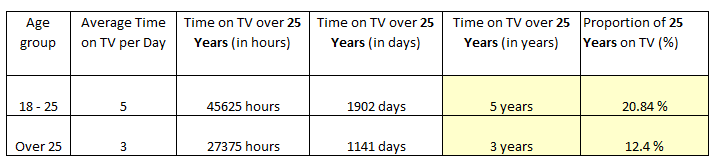

In the UK, 18 – 25 year olds and over over 25 year olds spend 5 hours and 3 hours per day respectively on average watching TV. I believe this is worse in the US.

If these charts don’t give you the shivers, I don’t know what will.

Note that we have not even considered all the monetary savings, health, opportunities, life improvements etc you could enjoy by investing your TV time in something more worthwhile.

Let us assume the average TV spend per household per month is £65 a month. This amount invested and compounding at 7% would return £50,898 in 25 years!

Get out of that trap today and you will not only see a drastic change to your finances but also to your productivity as you won’t believe how much more free time you’ll have!

I did what I am preaching and it’s totally liberating. Although I am still pondering on how I’d deal with my time and money commitment to the next series of Game of Thrones 🙂

Related: 9 Smart Ways to Invest £1,000

2. Excessive holidays

I love holidays and could literally spend half my entire year globe trotting if I could.

I dream up all kinds of places I want to visit and I like the #TakeMeThere and all the beautiful dreamy images.

Hands up, I have even been guilty of over doing it, and last year was a classic example as I believe I visited 3 continents!

However, all that said, if there is a financial goal you want to knock out in the future, then you either have to be making a tonne more money that you’re spending, or face the reality of scaling back.

Related: 85 Ways to Make Extra Money

I spent about £12,000 travelling last year, in what was an exceptional year. I made up all kinds of excuses to justify it, and now I kick myself thinking about it.

This year though, the scales have fallen off my eyes and I realise I don’t have to stay 5 star all the time or travel just because British weather is so appalling.

Our budget has been slashed by at least 50% and we are ploughing it all into equities to diversify away from property abit.

3. Take Aways

Do you have the “Just Eat” app installed? And order your take aways on autopilot at the click of a button?

I particularly have a gripe with take aways because more times than not, the stuff we consume is unhealthy garbage!

Have you ever come across health take aways? I actually think this would make a great business idea.

There are people who understandably can justify the cost of take away food.

They make such a killing that it would be uneconomical to spend time cooking.

I still prefer carefully sourced home cooked food and expect this to continue into the future. If you spending £30 – £50 a week on take aways, then do please think again!

4. Expensive New Cars

I get it, you want to feel good about yourself, so you go out and buy a new car to improve your perceived status.

Or you come from a culture where being seen to be successful has everything to do with what car you drive.

This is possibly one of the worst investments of all time.

Especially if you’re buying one of those expensive German cars.

The thing about cars is that there are really two costs you’re being whacked with.

a. The cash cost of buying the new car.

b. The depreciation of that car every year as the second hand value deteriorates.

The throw in the crazy maintenance tied to car – annual taxes, servicing, insurance, car finance costs etc. All burning a hole in your pocket and future.

Consider doing what I did instead if you must buy a car. Buy second hand and buy electric!

Related: My Secrets to Saving Money

5. Phone Upgrades

Do you remember when we just had the Nokia 8210 and the like? You know, before the smart phone arrived on the scene.

I seem to remember people made calls with their phone and were not too bothered about getting the next upgrade.

I blame the iPhone for this new culture and these terrible networks for their appealing deals.

Then again, thinking about it, we should be blaming ourselves for not sticking to our guns and not taking an upgrade.

One of my uncles recently found out that it wasn’t compulsory to take the upgrade offer. Wow!

Walking past the Apple flagship store on Regent Street as I do daily, I see an army of frantic consumers pouring over the latest £1000 phone.

Many of whom probably have no money to their names. This culture must stop!

Get a phone (not the very latest) and ride it for at least 3 years to get all the value out of it. Save money and grow your freedom fund.

6. Gym Memberships

There are many people with good intentions, especially in the new year, who start off the year with all kinds of health related goals.

Alot of them sign up to gyms throwing away £50 – £85 a month, without the discipline of keeping up with attendance.

A friend of mine actually had two memberships being paid for and was attending none. I know for certain that there are many others in the same boat.

The thing I struggle to understand is, if you hustle so much to make money, why get lazy and give it all away?

I prefer walking, running and cycling – All free. There are many parks around, and it seems a no-brainer not exploring these.

Sometimes, I do dancing too with my wife and kids. But one thing I am not doing is paying any gym and not attending.

7. Retail Therapy

Retail therapy aka accumulating stuff that really don’t make you happy, definitely ranks highly among these 7 non-essentials.

The thing about this is, some people actually do it as a way of stopping themselves being lonely.

These deeper issues are what need to be tackled in order to stop one spending their way into debt or perpetually being poor.

I’d recommend hanging out with friends who really don’t care a great deal about what stuff you have, and instead build you up in a different way.

Related:

Plot Your Escape. Choose Financial Independence

5 Debt Realities and What To Do About Them

What non-essentials are you finding hard to give up spending money on?

Do please share this post if you found it useful, and remember, in all things be thankful and Seek Joy.