Below are a number of media bits that we’ve been fortunate enough to have been featured on:

2020:

TV:

ITV News:

How our financial decision making is changing because of the pandemic. Exploring Money Wellness in individuals.

In November 2020, I contributed to this piece on ITV News about Money Wellness, given the challenging year that many people have faced financially as a result of the global pandemic.

PODCAST:

Meaningful Money Podcast:

September 2020 – I met with my good friend, Pete Matthew to talk about my experience as a black African man living in the UK on the back of recent racial injustices.

This is a raw episode with me sharing things that I’ve never shared before without holding back. Please listen with an open mind 🙂

Here is the official episode description:

This is an important episode of the podcast, I reckon. Today I’m chatting with Ken Okoroafor of The Humble Penny, one of my favourite UK Personal Finance YouTube channels and blogs.

I reached out to Ken for input after the murder of George Floyd by police officers in the US, and the global outcry following it. I knew that I’d get honest and articulate responses from Ken, and that also follows for my conversation with him today.

Real Money Stories:

October 2020 – I hung out with Jason Butler (JB) for what I can only describe as a powerful walk down memory lane.

JB has a very interesting way of asking questions and I thoroughly enjoyed spending this moment of my life with him.

I shared things on this episode that I’ve never shared before like what life was like during my upbringing in Lagos and school life over there.

Here is the official episode description:

This week on the Real Money Stories podcast, I speak to Ken Okoroafor, founder of The Humble Penny. Ken grew up in Lagos, Nigeria until his family moved to the UK when he was aged 14. As well as the culture shock of adapting to life in the UK, Ken was acutely aware of financial differences between his secondary school classmates.

‘Ashamed’, ‘lonely’ and ‘unseen’ are all words he uses to describe how he felt due to his family’s lack of money and different ethnicity to others around him. Finishing university with a first-class degree, Ken decided accountancy would be a good path to pursue.

Undeterred by the lack of black representation in the industry, he was successful in getting a position in one of the UK’s top 10 firms. Having temporarily succumbed to the effects of ‘lifestyle creep’ early on in his career, Ken got himself back on track, reminding himself what really matters in life.

Having achieved financial independence aged 34, he and his wife, Mary, decided to share their money story in order to empower others via The Humble Penny.

Everyday Leadership Podcast:

September 2020 – Meeting Sope and being invited to his podcast was one of my highlights of 2020. In fact, after this awesome chat with this incredible father and leader, I was invited to join his private prayer group with other founders.

I loved this episode and hope you do too.

Here is the official episode description:

In this episode I talk to Ken Okoroafor went from Topshop assistant to achieving financial freedom (becoming and living completely debt-free) in just over ten years and in today’s episode we find out how he achieved this. We also discuss parenting and not conforming to cultural Nigerian standards, making the bold decision to quit a 6 figure job during the pandemic, racism, faith, leadership and so much more.

In Her Financial Shoes:

September 2020 – I met up with my goof friend, Catherine Morgan to talk all things Financial Independence.

Catherine and I share business growth tips on WhatsApp all the time, so it was fun meeting her officially on her podcast to talk about the 9 stages to Financial Abundance.

I particularly like Catherine because she is ambitious and we think the same from a mindset perspective. I hope you enjoy this one 🙂

The Mojo Podcast:

August 2020 – I did The Mojo Podcast. This is one of my most fun podcast episodes. We talked about:

- how to have a radically different relationship with money,

- what mojo means to me,

- dealing with the struggle of the transition from my corporate CFO onto entrepreneurship at The Humble Penny

- Why I quit my corporate job to pursue a different lifestyle led by the desire to re-discover my fatherhood, etc.

Irish FIRE Podcast:

In August 2020, I was a guest on the Irish FIRE Podcast. Topics covered in the interview include:

1. How I and my family were able to become financially independent within 10 years, through investments, multiple cash flow streams, and businesses.

2. How can you use two hours per day to create a dream life?

3. How do you keep your get up and go and learn from your mistakes?

4. How do you deal with fame and finding the courage to put yourself out there?

5. Is your house an asset? Should you pay off your mortgage, or invest?

PRINT:

The Sunday Times:

May 2020 – We were featured on an article on The Sunday Times talking about how the global pandemic impacted our Financial Independence position and how we managed as a family during this very unusual season:

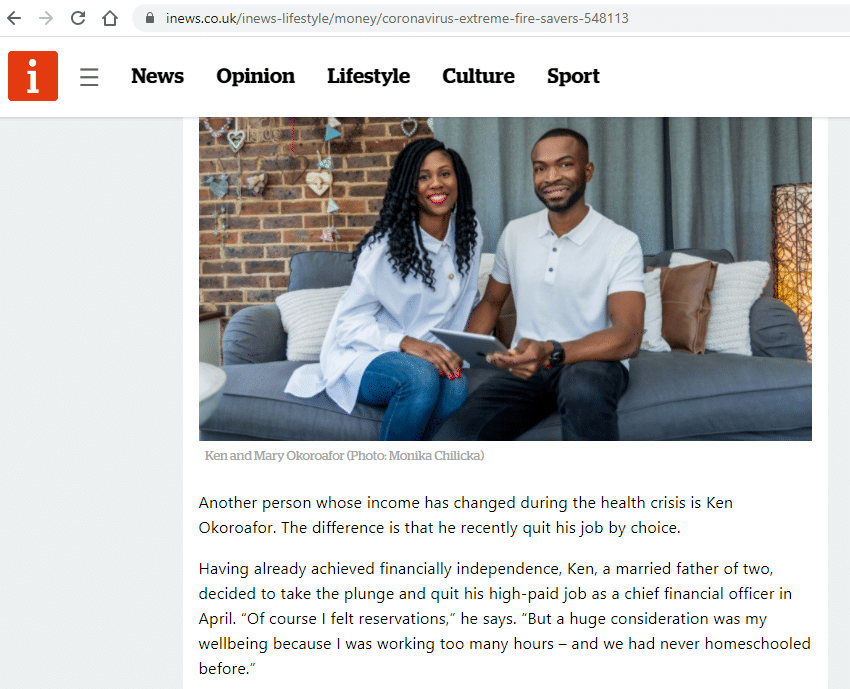

iNews:

July 2020 – We were featured on an article on iNews talking about Financial Independence over the pandemic:

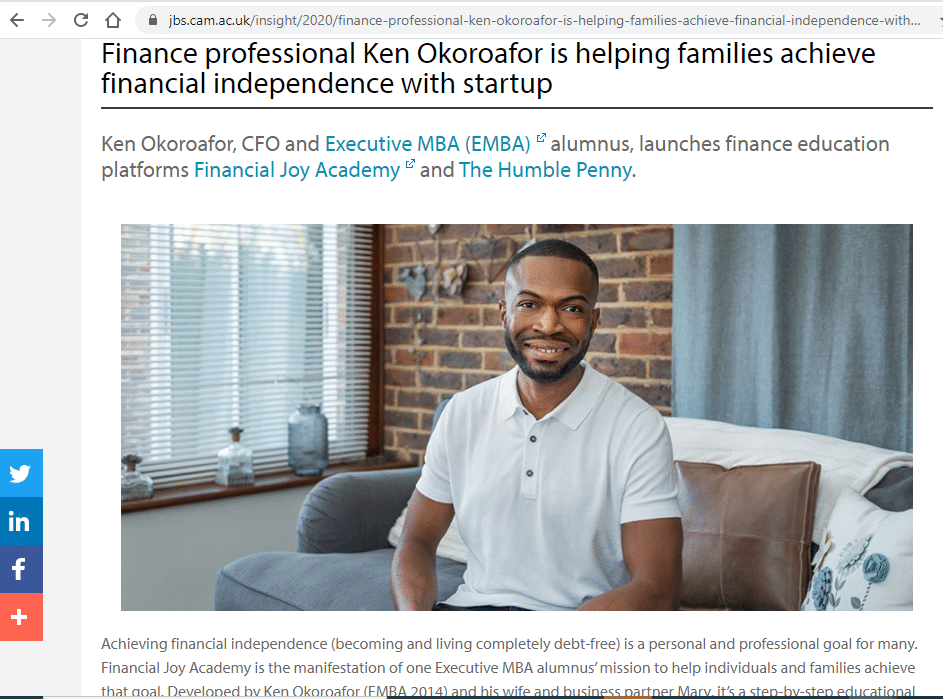

University of Cambridge (CJBS):

April 2020 – We were featured on an article by Cambridge Judge Business School about our launch of Financial Joy Academy and our core mission to help 10,000 Families to achieve Financial Independence this decade.

Read The Cambridge University article

RADIO:

BBC Radio 4 (You & Yours Show):

January 2020, I was a guest on The You & Yours Show on BBC Radio 4 with Winifred Robinson. We talked about debt, the challenges that many face and how families can better manage debt in the new year:

2019:

TV:

BBC 2 (Politics Live):

What would you do if you were Financially Independent? Want to retire in your 40s?

In a recent interview in 2019, I did a short film with the BBC sharing some thoughts on savvy saving.

BBC 1 (Inside Out):

I thoroughly enjoyed hanging out with the BBC for this short film, which explored the lives of various people at different stages of the journey to Financial Independence and optional Early Retirement.

I’m pleased to see more and more people going on this money journey and getting their financial lives in order.

Channel 5 News:

Talking about what it takes to become Mortgage Free before the age of 40 and other effective ways to save money to achieve Financial Independence and optional Early Retirement (F.I.R.E):

YOUTUBE:

Steps To Investing:

RADIO:

BBC Radio 4 (You and Yours Show):

I was interviewed (with a friend, Clare) in August 2019 by Winifred Robinson about Financial Independence on this show :

BBC Radio 94.9 F.M. (UK):

Discussing Early Retirement and the importance of a high savings rate. Audio Link below:

PODCAST:

Informed Choice Radio Podcast:

I enjoyed a cracking time in November 2019 talking to Martin Bamford about The Journey to Financial Independence and why I see Financial Independence as a Super Power! Really fun podcast filled with some interesting questions. Loved it!

Shades of Black Parenting Podcast:

In November 2019, I met up with the lovely Samantha and Ola from Shades of Black Parenting Podcast to discuss ‘How to Make Your Child a Millionaire’, Building generational wealth and we unpacked the journey to Financial Independence as a family!

These guys are the hospitable podcast hosts ever! They fed me some amazing food and even gave me a goodie bag! Love them both! 🙂

Cash Chats Podcast:

Andy from the Cash Chats Podcast came to meet me in July 2019 and we sat together and discussed Financial Independence. It was nice to hang out with another UK Money Blogger and I really appreciate the opportunity to be featured on his podcast.

Andy also asked some very practical questions. Check it our below:

Dope Black Dads Podcast:

This was an amazing podcast episode and I really enjoyed hanging with the guys at the Dope Black Dads Podcast in London. We talked about business, life, money, relationships, etc.

The episode was pretty much a fireside chat, but revealed a big surprise when one of the hosts revealed “I am BROKE! Help!!”. We spent the rest of the episode suggesting ways that he could stop being broke forever! Enjoy.

Over The Bridge Podcast:

I Loved every moment of sharing my life experiences so far and journey to Financial Independence with the amazing guys at the Over The Bridge Podcast.

Massive thanks for the opportunity, brothers!

Financial Independence Europe:

The amazing guys at Financial Independence Europe Podcast featured me on Episode 18 – How FI Is All About Personal Development.

UK FI Pod:

Thanks to The UK FI Pod for my first ever podcast! Talking Life, Family, Money and Financial Independence:

PRINT:

![]()

I contributed to this important piece in November 2019 on The Racial Debt Gap in the UK and how it disproportionately affects Black and Asian households.

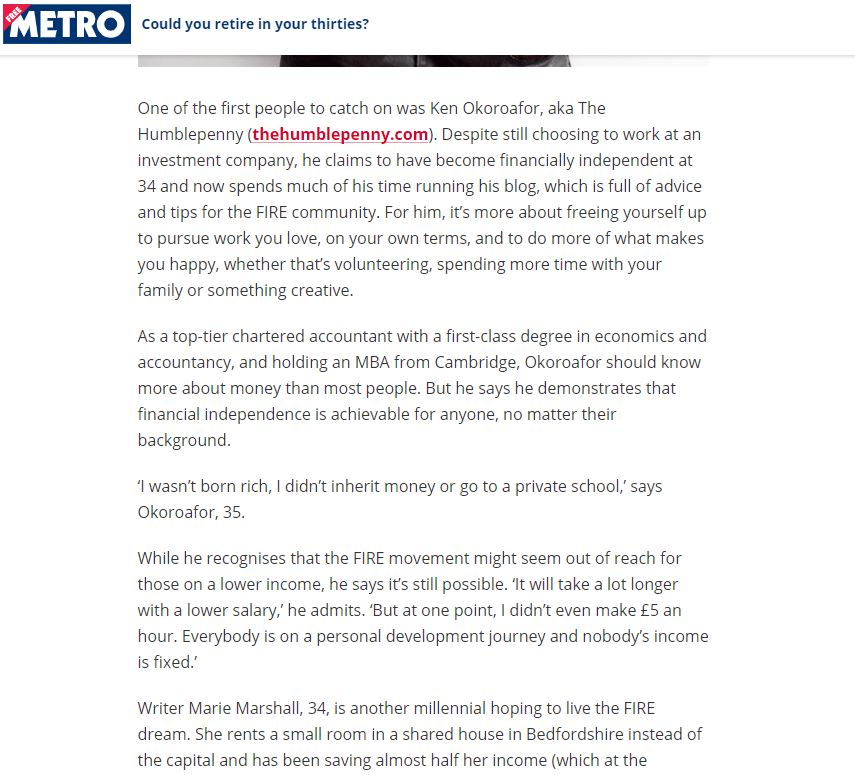

Can You Retire In Your Thirties?

Online interview covering some of the hacks and tips for frugal living, early retirement and mortgage freedom:

Achieving Financial Independence and optional Early Retirement at the age of 34

COURSES:

Interested in Financial Independence? Want to go beyond this being a good idea?

Want to take action and create a Personalised Plan unique to you?

Join us on an adventure to help 10,000 families to achieve Financial Independence this decade via our membership programme:

Other courses include:

- One Grand Plu$ – 5 Breakthrough Passive Income Ideas for £1000+ per month

- Super Simple Investing – 12 Days To Investing Confidence

- Budget For Life – The Only Budget You’ll Ever Need.

See other courses at our Online School at Financial Joy Academy

CONTACT:

For any media appearances, talks on stages, etc, please feel free to contact me via email on Ken@thehumblepenny.com.

Many thanks

Ken

FREE Practical Money Course!

This FREE course will show You How to Make Money, Invest for Your Future, Save & Budget better, Generate Cash flow, Work out & Grow Your Net Worth, Manage Debt and work towards Your Financial Independence!

Start Today and Change Your World! Be Fearless!!