How Much Money You Should Have Saved by Age

Ever considered how much you should have saved by age?

I recently gathered thoughts from friends in The Humble Penny community and asked what advice they would give their 20-year-old self.

The one overwhelming piece of advice was that people would have saved more money earlier!

A number expressed regret for having splashed out on stuff growing up and would much rather have saved.

I am totally guilty of this too and really chose to live life in the moment.

Saving money seems like a no-brainer to most people in retrospect, whilst spending money seems a heck of a lot more attractive in the present.

The thing I find really interesting about saving money is the opportunities it could open.

A lot of people who save tend to save money for a rainy day, which is a good thing in itself.

However, saving is really a vehicle for much more upside potential:

- Plotting your escape and working towards the SuperPower of Financial Independence and the option of Early Retirement.

- Investing in assets that work for you. If you have a long-term view, compounding will fascinate you.

- Starting a business or side hustle and generating profits you can reinvest in other asset classes for cash flow.

- Taking time out as an adult to travel around the world as you might always have wanted to.

- Helping others in need and teaching them what has worked for you so far.

Having said all this, the trend towards saving money is massively on the decline in the US, UK, Canada etc.

Many continue to have a never-ending spending hangover.

NEW content on Our YouTube Channel – How To Save Money By Age:

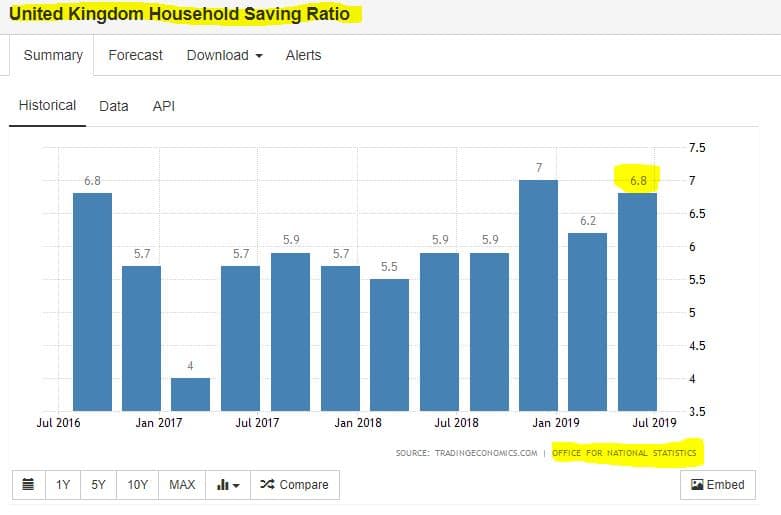

According to the recent Office for National Statistics research, the estimated UK household savings rate was 6.8% in July 2019 and forecast to decline further.

*Savings ratio estimates the amount of money households have available to be saved as a percentage of their total disposable income

6.8% is only a fraction of what people need to be saving in order to build up a decent retirement pot one day.

There is clearly an issue with people either spending too much and therefore not saving enough, or just not earning enough of an income.

Or perhaps people just don’t have sufficient foresight about their future even though the signs of what to come is all around us today.

Life has its many challenges and with many things competing for our attention and money.

Let me paint you a picture of how life could play out if you don’t start taking drastic action today:

Age 20 – “I’m young and doing my thing. I just want to have fun. I have loads of time. 65? That’s light years away.”

Age 30 – “I am in a relationship. Ah man, I have big car payments monthly plus I like fine wine and enjoy nights out on the weekends. I will get started later”

Age 35 – “Save? We have had our first child! Nappies, baby food, blah blah blah..Have you seen how expensive childcare is?”

Age 40 – “Gush we’ve got two kids! Yikes! We haven’t been on holidays for 3 years and our second car is worn out and needs replacing. We’ll start next year”

Age 50 – “We’ve started paying for university fees and our credit cards are maxed out. We keep worrying about how to prepare for retirement but just can’t find the room in our budget to do anything about it now. Feels too late. Why is life so crap? I wonder how Ben and Lucy seem to manage it all.”

Age 60 – “Where did time go? Darnit, wish I had planned my life well. All I have to look forward to is the state pension of £159.55/week if I am lucky. Looks like I will never be able to retire. Plus I no longer have the strength I had. Wish I took more risk.”

Age 70 – “My children are making the same mistakes as me. Oh my! Am I a failure? I will teach this stuff and make sure I stop them becoming poor too before it is too late and my grandchildren also get affected.

The above is the sad reality for many people today. What story do you want to tell one day?

If you’re reading this and currently coasting through your life with no defined plan for the future, then I urge you to drastically rethink your path.

Especially if you’re living through the crucial wealth accumulation stages of life.

The best time to begin saving was yesterday, however, where you’re is the only place to start from and now is the only time you have.

And let’s not forget, working for money and retiring at 65 is not the dream. It is the old way of doing life.

If you really want to enjoy your life, travel, spend more time with your family, pursue passion projects etc, then you must Plot Your Escape.

Choose Financial Independence and aim for the option of Early Retirement.

Given you have to manoeuvre through the various life milestones above, assuming you started saving today, at what rate should you save at based on your age? And how much should you have saved?

NEW content on Our YouTube Channel – Why Your Savings Rate Is Critical For Financial Independence:

There are a number of approaches and guidelines for figuring this out:

1. Multiple of Salary

Fidelity recently conducted some research and suggest that you should have 50% of your annual salary in accumulated savings by age 30.

For example, if you’re 30 now and earning £40k per annum, then you should already have £20k in savings at this age.

This would require saving 15% of your gross salary beginning at age 25 and investing at least 50% in equities.

That’s because, at such a young age, you typically have a long term horizon (>20 years) to invest your money.

As such, realistically your asset allocation should high in equities and low in bonds.

Other suggested savings benchmarks are as follows:

Age Salary multiple Savings if earning £50k

25 15% x gross salary £7,500

30 50% x gross salary £25,000

35 one x gross salary £50,000

40 two x gross salary £100,000

50 four x gross salary £200,000

60 six x gross salary £300,000

67 eight x gross salary £400,000

The above is a simplistic illustration and makes a number of assumptions such as lifestyle and income remaining fixed.

However, you hopefully get the point, which is that you should start early, stay consistent and ramp up as time passes.

2. Other Multiple

Another piece of research similar to Fidelity suggests that you should be saving 25% of your gross salary starting in your 20s.

This figure includes all savings in your tax accounts (e.g. ISA and SIPP) as well as employer contributions.

Following this savings rate should allow you to have accumulated the equivalent of your annual salary in savings by the age of 30.

Continuing this savings rate should lead to the following savings goals:

Age:

35 – two x gross salary

40 – three x gross salary

45 – four x gross salary

50 – five x gross salary

55 – six x gross salary

60 – seven x gross salary

65 – eight x gross salary

Now here’s the thing, not everyone has the opportunity to begin or have saved in their 20s and continue saving into their 60s.

All kinds of things can happen – one could immigrate and start from zero (just like I did), have a long-term illness or have a change of fortunes etc

Related post: How To Set and Smash Your Goals

This is why I advocate that people choose Financial Independence as soon as they possibly can and begin to design their lives to achieve the desired outcome.

NEW content on Our YouTube Channel – How To Save Money – Our 60% Savings Rate:

My preferred method for analysing retirement income (especially if you want to retire earlier) and what should be saved is as follows:

3. The 4% Rule

To determine how much you’ll need in retirement, take your desired annual income and divide it by 4%.

4% represents a Safe Withdrawal Rate (SWR) from your freedom fund or portfolio.

For example, if your desired annual income at retirement is £50k, then dividing this by 4% gives you a pot of £1.25m.

Another way to look at this is that you have assumed that your total expenses in a year are £50k.

Therefore, multiplying this by 25 gives you £1.25m i.e. you have 25 years’ worth of expenses.

If this pot of money were invested and returning, say, a 6% compounded return net of inflation, then with a SWR of 4% per annum, you should theoretically never run out of money!

There is an inverse relationship between your savings rate and your retirement age. The higher your savings rate, the younger you’ll retire and enjoy freedom.

If you think about this, cutting your spending rate (and increasing your savings rate) is much more powerful than increasing your income.

This is because every permanent drop in your spending has a powerful double effect:

- It increases the amount of money you have left over to save (and invest) each month.

- It permanently decreases the amount you will need every month for the rest of your life.

Achieving a permanent drop in your monthly spending requires a lot of discipline and a lifestyle shift.

Note: 4% is really a maximum. Anything between 3% and 4% would be more realistic. At a 3% SWR, you’d need a pot of £1.67m.

NEW content on Our YouTube Channel – 10 Things To STOP Paying For NOW!:

Related Resources:

- FIRE SuperPower™ – The Video Course to help you achieve Financial Independence

- My Best Resources – Money Saving, Side Hustles Tools, Books etc

- Private Financial Coaching

In summary, saving money can be tough, but it is entirely necessary and possible because what you spend is under your control.

It is easy to point to the many things you have to pay for and justify why you haven’t saved.

I’d challenge you and say that all those things you have to pay for come down to choices you have made.

The most important thing you can do today is to create a well-defined plan that is unique to your future goals.

Then do everything possible to optimise your life and increase your savings rate, and keep it consistent.

If you’re struggling to do this, reach out to someone you know who has or feel free to Contact Me.

Your income is also another lever for improving your savings rate and is never ever fixed.

Given there is opportunity all around us, don’t subscribe to the doom and gloom around but instead explore your creativity and talent, and seize an opportunity.

NEW content on Our YouTube Channel – How We Live Well On A £50 Food Budget (Family of 4):

Related Content:

- 7 Guaranteed Ways To Make An Extra £1,000 A Month

- 85 Ways To Make Extra Money

- 50+ Ways To Save Over £10,000 Every Year

- Plot Your Escape. Choose Financial Independence

- How Much Money Is Enough?

What has been your biggest challenge to saving? Do you hope to retire earlier one day? If so, what are your plans?

Do please share this post if you found it useful, and remember, in all things be thankful and Seek Joy.