Reader Case Studies – Is Life Insurance Worth Paying For Decades?

Welcome to the second Reader Case Study on The Humble Penny.

The goal of these case studies is to solve real problems.

If you’re new this, the case studies are a way for me to better interact with the subscribers of this blog.

I refer to the subscribers as The Fearless Generation because they’ve got to a stage in life where they’re seeking another path.

This generation wants to be debt free, create multiple incomes ethically, become financially independent, live fulfilling lives and ultimately Create Financial Joy.

These case studies are a way in which I can help to solve their problems via free coaching.

Solving such problems is what The Humble Penny was created and exists to achieve.

In addition, they get crowdsourced responses from other readers in the comments below.

Together, we can help ourselves and each other.

As these case studies are real-life situations, I commit a fair amount of my time to considering them and responding.

Case Studies will be published monthly. If you want your problems solved, simply write to me and tell me how I can help.

The key requirement is that you must be a subscriber of The Humble Penny.

I would also appreciate as much detail as possible about your situation and a clearly articulated problem.

Your problem has to be within one of the categories of this blog. I.e. Money Making, Money Saving, Investing, Side Hustles, Debt Free, Financial Independence, Blogging, Relationships, Life etc.

You can also choose an alias for privacy reasons if you prefer.

If your case is chosen, I’ll write to you immediately and let you know.

Please make no assumptions. Simply write in and I’ll attend to you personally.

Now let’s dive into this month’s case study:

LETTER FROM REA:

Hi Ken,

I wonder if you would consider using my information request below as a case study on The Humble Penny blog?

Re: A view on life insurance and critical illness cover

Following my separation 5 years ago, I have very recently remortgaged to allow me to release some equity to my ex-partner so that I may keep the house solely in my name.

I have remortgaged for less than 50% of the house value. 21-year term at 2.75% fixed for 5 years.

I really needed to feel secure for the next few years in knowing what my minimum repayments would be.

House value £320,000

Remortgage £147,000

When we had a joint mortgage we never had life or critical illness cover.

Upon remortgaging I felt pushed by the bank into taking out both with Scottish Widows for the term of the mortgage, mainly as I was/am a single mortgage applicant.

They quoted around £26 per month for 21 years. Total cost of around £6,500 for a potential benefit of around £122,000.

This seems like a really long time to be tied into an insurance policy (21 years) but I am a complete novice in this area and as I am still within my cancellation period (20 days left to cancel), I am deliberating on what to do.

At the time of signing up to this I was also changing jobs into a very different career move and to be honest my sole concern was just getting the remortgage agreed so as not to lose the family home.

I cannot find any independent information that gives an unbiased view or whether it is normal to tie myself into policies like these that I will potentially be paying into for 21 years without an option to review!

Maybe I’m looking at it incorrectly, but I wouldn’t tie myself into car/house or other types of insurance for that length of time! Is this usual?

I wondered whether you may know of any good resources that could help me understand the world of life/critical illness cover.

Or whether anyone in The Humble Penny community could offer a view.

I do think that life insurance seems a good idea as even though my youngest of two daughters is 21, I’d like to know that the mortgage was taken care of.

However, what I have managed to read on Critical Illness cover, it can be very difficult to get an insurance company to pay out, which made me consider whether the premiums would be better invested elsewhere.

The life and Critical Illness cover were sold as separate entities.

Through my long service employment I am entitled to six months full pay, six months half pay sickness benefits.

This gives me some peace of mind at least for the initial six months period should I fall ill. Other than my mortgage, I am debt free.

I would really appreciate some feedback on helping me to better understand what I could be getting myself into.

Also, what the Humble Penny community views and experiences are.

I’d also like to add that my annual earnings are under 30k.

My youngest daughter has one more year to complete at university unless she continues on to complete her masters (I hope she does).

I contribute in supporting her financially, so once she has finally finished uni, this will free up some more money.

After shaving back everything budget-wise, if I can spare up to £200 per month how would this be best invested? Options I am considering;

- extra repayments on my mortgage

- Additional Voluntary Contributions (AVCs) – I’m in a Local Government Pension Scheme and have been since 1995. Although if I am completely honest, although this makes me feel a complete idiot, I don’t even understand my pension statements!

- investing – I have absolutely no clue how to do this either!

Ok, so I’m really putting myself out there now. Feeling very naive!

Again, thank you so much for the time you invest in assisting us all to grow our financial knowledge, and for providing the platform to offer support.

Kind regards

Rea

More About Rea

How old are you? And where are you from?

I’m 48 and I live in the RM15 postcode (Essex/Greater London, UK).

What are your dreams for the near future?

I definitely dream about taking a holiday.

It’s been quite some time since I was able to do this as I have had other priorities. Especially supporting my youngest daughter financially through university.

What are your hobbies?

I really enjoy walking, whether it be in the countryside, by the sea or in our beautiful city of London. I find it very relaxing.

Also, I love gardening and invest quite some time in keeping it looking like a peaceful little Mediterranean oasis.

It’s my home escape! I like to grow my own lettuce, tomatoes and herbs.

I enjoy nurturing their growth with the added benefits that they are edible!

I’m a very ‘crafty’ person and can turn my hand to almost any kind of craft.

I love to cook.

What do you do for a living?

I work as Police staff. It’s a really interesting job that I love doing, but it’s a highly confidential environment.

What’s your biggest money related fear or concern?

Still having mortgage debt when I retire and also not having enough money to support my retirement.

I guess I feel a little panicked about this when I sit and think about how this may pan out for me if I am still on my own then.

This leaves me feeling rather vulnerable.

But I can’t overthink it because who knows what the future holds.

I am glad to not have debt other than my mortgage to rid myself of, but I do feel as though time to sort this is slipping away!

I would like some kind of plan of an action plan to at least try to improve my financial future, if possible.

KEN’S RESPONSE TO REA:

Dear Rea,

Thank you for writing in and sharing your story. We really appreciate it.

I read your case with much interest because life insurance is one area in which a lot of people have questions and don’t know what to do.

I’ve had a few friends reach out as they too try to decide if it’s something to consider.

Before I dive into my thoughts on your situation, I’d like to point out that what I am writing about below is not financial advice.

It’s boring but important admin that I need to make clear. As such, always seek professional advice if you need to.

Now onto your case…

Firstly, hats off to you for carrying on with life post what I assume would have been a difficult divorce.

You’ve also done amazingly well to have no other debt except the mortgage, whilst also supporting your daughters.

It’s my sincere hope that you continue to find your way through the challenges life throws.

Having read your case, I’ve made a few observations below:

Observation 1: Life Insurance & Critical illness Cover – What & Why? Should you get involved?

Life insurance is a form of protection that offers a monetary benefit in the event of key life events such as death and/or terminal illness.

The amount of payout depends on the type and extent of cover you buy and for how long.

Some people don’t buy life insurance due to the conflict of interest that exists with the advisers selling these products.

Others don’t bother simply because they just don’t have enough objective information about it.

There are mainly two types of life insurance:

i) Term Life Insurance – These run for a specified period of time e.g. 5, 10, 20, 30 years. If one dies or has a terminal illness in this period, then there will be a pay out.

ii) Whole-Life Insurance – This is guaranteed to pay out and there isn’t a time bar as to when death should occur.

Term life insurance is way cheaper and usually costs about £1 a day assuming you have decent health and start as early as you can.

Whole life insurance could cost at least 10 times the cost of term life insurance. It also offers a larger incentive to financial advisers.

Life insurance policies generally have exclusions and won’t pay out for certain illnesses or causes of illnesses.

Such things as death from alcohol or drug overdose won’t be covered for example.

By excluding certain illnesses, insurance companies have invented new revenue lines for themselves.

In comes the likes of Critical illness cover, Permanent disability etc.

Insurance companies usually offer these together. For example, if they sell you Life Insurance, they’ll also upsell you Critical illness cover.

What is the cost of life insurance based on?

Term life insurance as I mentioned earlier can cost as little as £1 per day. However, other factors that affect this include:

i) Your state of health

ii) Age

iii) Current lifestyle

iv) Whether you smoke or not

v) How long you want the term of the policy

vi) How much cover (money) you want.

Do you actually need life insurance?

You typically need it if you have:

i) A mortgage

ii) Dependants or a family (usually young children)

iii) Imbalance re income between spouses, which creates overdependence on one person.

There are ofcourse other reasons why some people take out life insurance. For example, some treat it as a wealth creation tool.

You typically don’t need life insurance if you’re single or on a low income and eligible for state benefits. Or if a partner earned enough for the finances not to be a worry.

If I sat in your current shoes, I would personally take out term life insurance. I’d do it for the higher of the mortgage term and the time left to retire.

Life Search offers Free expert ‘advise’. We personally used them and found their personal touch very helpful.

Reassured are ‘non-advised’ market leaders.

A non-advised brokerage simply takes the information you provide (age, weight, smoking status, budget etc) and search for the best deals on your behalf. They do not offer advice or lead you to a particular policy.

Observation 2: Your Big Fear About Mortgage Debt

I have had a long relationship with fear. However, today I feel I ride it as though I am surfing on a big wave.

The thing I’ve learned over time is that you can either let fear dominate you, or you choose to dominate it.

What I mean by this specifically is that you have to challenge your fear and use it to your advantage.

How? By being honest with yourself and being proactive in solving the related concern you have.

I say this having fought many small and big battles, and continue to.

Your current mortgage debt of £147,000 at the age of 48 is not astronomical on the face of it.

Although it is compared to your annual income of circa £30,000. So around 5 times.

I can see why this can appear daunting. However, if I had to solve this problem, I’d solve it starting with what you already have:

i) An existing income – You’ve mentioned that you could potentially have £200 spare per month.

This can do some damage to your current mortgage via overpayments.

I’d worked out that at 2.75%, an extra £203 per month reduced your mortgage term to 15.5 years from 21 years.

Now whether you choose to commit spare cash to your mortgage requires deeper consideration.

More on this in “Observation 4”.

ii) Your existing talents – You have a natural passion and talent for cooking and making crafts.

More on this in “Observation 5”.

iii) Relationships – This where a large amount of your future wealth rests, although it might not seem like it right now.

Your present and future relationships will help lift you out of this debt if you so choose that as an output.

How you do it is again tied to # 1 and 2 above.

To be more specific, I want to share a perspective I don’t often share on this blog.

I’m only doing this to help you realise your fortunate position and what is possible.

My mum moved to the UK around the age of 44 twenty years ago. I am focusing only on my mum so you can relate more (I hope).

Try to imagine your life 4 years ago with nothing. Zero assets, no pension, no job, no relationships, no history, and many other barriers.

Within 20 years, she has run at least 12 businesses, failed and succeeded at many.

In this time, she has acquired a number of UK properties, and with a few now mortgage free and making passive income.

She also owns assets abroad, and at 64, she has a business that employs about 50 people.

Although we’ve never quite looked at it this way, she is a quiet millionaire.

Now, 20 years ago, there was no chance we could have envisioned any of this. All we knew was that we had nothing and had to use what we had in our hands.

We needed to take risks to survive and truly get out of our comfort zones. And we needed to stay hungry in order to lift ourselves out of our situation.

I am telling you all this to make you believe.

Once in a while when I read a book to our sons, there is often a maze at the end. Something like this:

Like the maze, one guarantee we have in life is that there is always a solution to our problems.

Like the maze, one guarantee we have in life is that there is always a solution to our problems.

Working backward from the end of the maze to the beginning is the fastest way we’ve found of solving the problems.

So I’d recommend the same approach.

When do you want to be mortgage free and how?

The more you ponder this question, the more your mind will get to work. Writing in with this case study is the beginning of that journey.

Feel free to watch my interview with Barney from The Escape Artist on how Fear can help you achieve Financial Independence:

Related Post: How Fear Can Help You Achieve Financial Independence

Observation 3: Security Is Important To You

Insecurity makes us nervous wrecks. I get it and fully understand.

Over my work life so far, one of the key things I’ve had to understand and keep tackling is risk.

Risk is in the eye of the beholder and uncertainty is inherent.

Although it might take some time for this to mean anything to you, what I am really trying to say is that risk can be controlled.

It can be reduced although not completely eliminated. The less risk you have, the more security you potentially have too.

Insurance is one tool that can be used to reduce risk. I use it for property investments, and in our personal lives.

For example, I have a term life insurance partly to mitigate the risk that I’m the primary breadwinner in our home.

Mary too has life insurance for similar reasons, as well as to diversify our risk. I.e. Two separate policies rather than one joint one.

But here is the thing –

We are only buying insurance that we think we need for the riskiest period of our lives.

As we’re soon to be mortgage free and working towards Financial Independence, the insurance is just a bonus.

Plus, it’s very cheap for the potential benefit! We each pay something like £29 a month for a 30 year term.

So, a good way to start this is to think about:

i) What are the top 5 risks (concerns) you see in your present and future life?

ii) Is there anything you can do about any of it?

iii) Can you do it without money?

iv) If no, what will it cost and which of the top 5 is worthwhile?

Pick health as an example. I know that cancer and the like are a possibility (however remote) and probably tied to diet.

I can either pay for critical illness cover, and/or I live healthily.

I’ve chosen the latter instead as it’s cheaper in the long term. Your assessment might be different.

Note that being proactive about reducing future risk and gaining some security does not mean that you have no faith.

I’m making this point deliberately because not knowing what tomorrow holds does not mean that we don’t act today.

Observation 4: Best Way To Invest £200 per month

I previously wrote a post on 9 smart ways to invest £1,000 , which you should read.

Given you have £200 monthly, I would invest it initially on supporting the suggestions in “observation 5” below.

Essentially, I’d invest it in growing your knowledge and confidence to try new things that will increase your income.

After that, you could either focus squarely on paying off your mortgage earlier or investing.

If you choose to pay off mortgage earlier:

At 2.75%, an extra £203 per month reduced your mortgage term to 15.5 years from 21 years.

However, this assumes your rate stays the same for 15.5 years and so does the amount.

As you pay off, your Loan To Value (LTV) will get better, which will give you better rates.

Provided you keep the overpayment amount the same, it will further reduce the term of 15.5 years.

This is partly what has helped us pay off our mortgage earlier.

If you choose to invest instead:

I’d personally put the money in a broad based index fund or ETF that tracks the S&P500 or FTSE All Share Index.

This essentially means that you invest and don’t ever have to think about what specific shares to buy and when to buy.

You simply keep buying the same index fund or ETF each month.

A broad based Index Fund helps you essentially own a piece of every single company on the index every month you invest £200.

As you do this each month, you are also benefiting from diversification as a result of ‘pound cost averaging’.

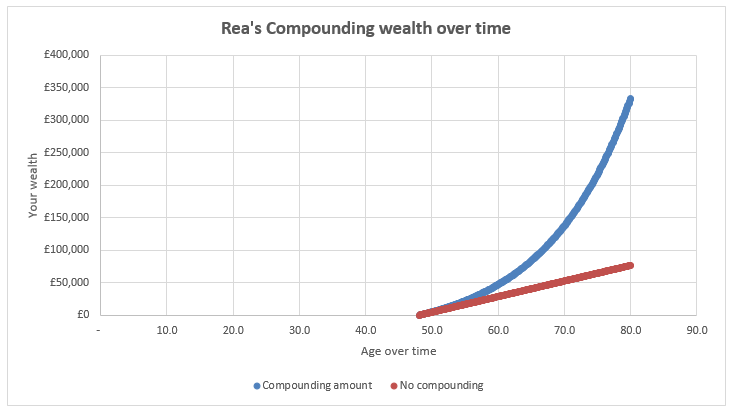

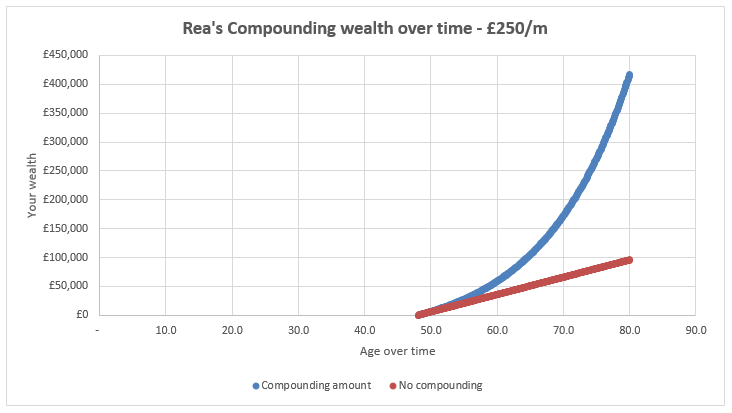

I did some workings on how this could look for you.

Scenario 1: Investing £200/month over 15.5 years. (same period you might have paid off mortgage):

You end up with £71,390 assuming an 8% return.

Scenario 2: Investing £200/month over 19 years. (Assuming you retire at 67 as increases are expected):

You end up with £103,068 assuming an 8% return.

In terms of what type of accounts to invest through:

A tax efficient account is what to go for. You can open one of these in minutes online.

I’d suggest a stocks and shares ISA if you want access to your money on an ongoing basis. Scenario 1 & 2 above can be expected in such an account.

Or Self Invested Pension Plan (SIPP) if you want a private pension in addition to the pension you have through work.

The benefit of the SIPP is that you get a tax rebate on your £200 each month.

So whenever you invest your £200, the government will rebate you 20% as a lower rate taxpayer.

E.g. if you invest £2400 (£200 for 12 months), you will get back £600. Total £3,000.

So effectively a 25% return (600/2400) before you’ve invested in the stock market.

The reason you get the rebate is that you are investing your £200/month out of net income you already paid tax on.

If you invest via a SIPP, the government give you back that tax automatically every month or so.

Scenario 3: Investing £250/month (£3,000/12) over 19 years in a SIPP. (Assuming you retire at 67 as increases are expected):

Note that with a SIPP, you don’t have access to your money till you’re 55! Plus you pay some tax at the end, usually on 75% of the balance.

As you can see, all scenarios point to you becoming richer and more comfortable as time passes if you position yourself well.

And I haven’t even looked at the impact on your pension if your employer is matching your contributions.

Nor have we counted any potential upsides from your activities in observation 5 below.

Observation 5: Your Talents – Cooking and Crafting

This is where I see the biggest potential future benefit.

Although I haven’t yet gone into a great deal of detail on this blog, the side hustle has been the biggest contributor to our Financial Independence.

What I’m really talking about here is taking risks in business using what you already know.

Many won’t admit it, but we all have spare time in our lives to do such things if we really want it that badly.

I gave you the example of my mum earlier and the same thing is repeated with my dad, brother, and sisters. Everyone is in some business or another.

This is because it is a tried and tested path to creating wealth.

My big recommendation is that you start exploring your passions and talents economically.

You’ll find the below podcast episode really interesting.

Watch “How I Built It” by Guy Raz – Episode: Chicken Salad Chick: Stacy Brown:

https://www.youtube.com/watch?v=42rQRRAkqw0

My Wild Card Thoughts

You Need A Life Design

Things are ticking along quite well, but you need to start making some of your dreams a reality.

You also need a solution to the maze. A way out that you can follow and gain more confidence for the future.

This case study should hopefully have given you some pointers. Spend some time thinking about what you actually want the next 5 – 10 years of your life to look like.

Don’t be afraid to be ambitious and set steep goals. You may well surprise yourself.

I’d also recommend thinking about how you can collaborate with your daughters.

They’re are a big part of what you have in your hands.

I hope this has been useful. Please feel free to reach out if you need further guidance.

Related posts:

- READER CASE STUDIES: Pay Off Large Debts Or Invest?

- How To Pay Off Your Mortgage Early And Why You Should

- 9 Smart Ways To Invest £1,000

- Financial Coaching

What are your thoughts about Life Insurance? Do you think it is worth paying for? Please comment below.

Do please share this post if you found it useful, and remember, in all things be thankful and Seek Joy.