PensionBee Review: Could Pension Savings Be Simpler? Ad | This is a paid partnership with PensionBee

If you’re like me, you’ve been on a career journey and had the priviledge of employer pensions.

You’ve been saving into your pensions for years and moved from one job to another over time.

As time passes, you end up with multiple pensions and the burden of keeping up with them all.

In addition, you want to keep saving as pain-free as possible whilst also making sure your money is working for you.

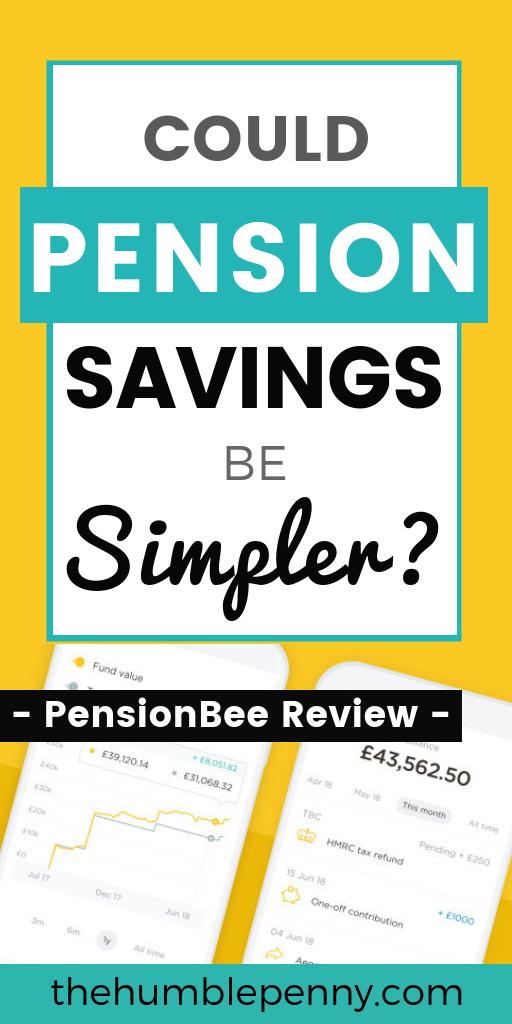

Given technology is making accessibility better, you probably want to be able to see your money on the go.

Pensions are usually the last bit of investments that we consider spending time on simply because a lot of us don’t expect to be touching them for decades.

However, this is where a big mistake is made as many have no idea where their money is invested and what fees they’re paying.

As such, years pass and wealth gets depleted mainly due to either lack of knowledge of our pensions or lack of effort to monitor our investments.

Thankfully, all of this can be changed today thanks to innovative companies such as PensionBee.

Who are PensionBee?

These guys essentially make pensions simple.

They take the pain out of pensions by helping you and me:

- Combine our multiple pensions

- Manage pension contributions, and

- Make withdrawals easy online.

All in one easily accessible place.

Saving money into a pension really has never been easier.

They were founded in 2014 after the founders struggled to switch pension providers on traditional platforms.

They’ve since grown from strength to strength and currently used by over 30,000 people.

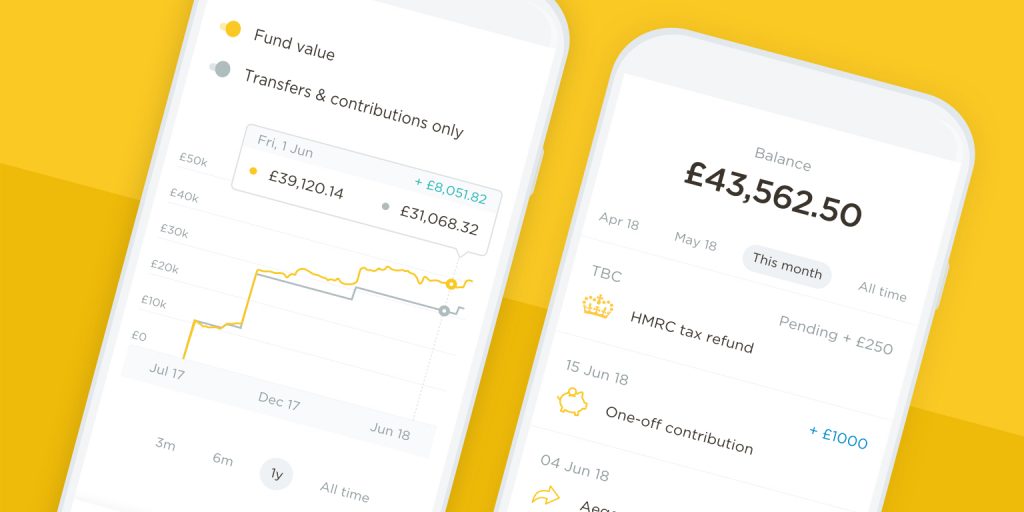

How does it work at PensionBee?

The process is pretty simple:

Go online or download the mobile app. → You pick your plan → Select your old pension provider names. → Hit Confirm.

They’ll communicate with you throughout the transfer process and you’ll have a dedicated Beekeeper.

If you selected a plan above, you can change them at any time without any additional costs.

There are currently 7 plans available and with different underlying aims. These plans are:

- Tracker – Invests your money in global shares, bonds, and cash.

- Tailored – Invests your money differently as you go through life.

- 4Plus – Aims to achieve a long term growth of 4% per year.

- Future World – Invests in companies that have an environmentally-friendly focus.

- Shariah – Invests only in Shariah-compliant companies.

- Preserve – Focuses on risk reduction and money preservation.

- Match – Invests in a mix of assets following the strategies of the wider pensions industry.

Each of these have “Plan Factsheets” that tell you which underlying fund you’re investing in by selecting that plan.

For example, the Tracker Plan has an underlying investment in the State Street Global Advisors “Balanced Index Sub-Fund”.

The fact sheet also shows you things like the:

- Underlying asset allocation of the fund,

- Fund performance over 1 year, 3 years and 5 years,

- Investment strategy of the fund,

- Fund objective etc.

For all 7 plans, there are 7 Underlying funds across 3 Investment Managers:

- State Street – Global Advisors Balanced Index Sub Fund

- State Street – Dynamic Diversified Sub-Fund

- State Street – Sterling Liquidity Sub-Fund

- State Street – HSBC Amanah Equity Index Sub-Fund

- BlackRock – DC Consensus 85 Fund

- BlackRock – Funds for the Tailored plan vary by age

- Legal & General – Future World Fund

Although past performance in all these funds has been good, it is not a guarantee of future performance.

What does PensionBee Cost?

Transferring your pensions to PensionBee is FREE of charge.

Once your portfolio has fully transferred, you pay only one annual fee, which is low and fair.

This one fee also covers any underlying transaction costs such as stamp duty reserve tax.

If your pension pot is under £100k, you pay in the range from 0.5% to 0.95%, depending on which plan you choose.

Soon as your pot is over £100k, your fee is dropped by 50% (for amounts above £100k)! I.e. range of 0.25% to 0.475%.

There are also no exit fees if you decide to leave at any point!

In addition, there are no additional fees if you decide to change your plan.

What do I really like about PensionBee?

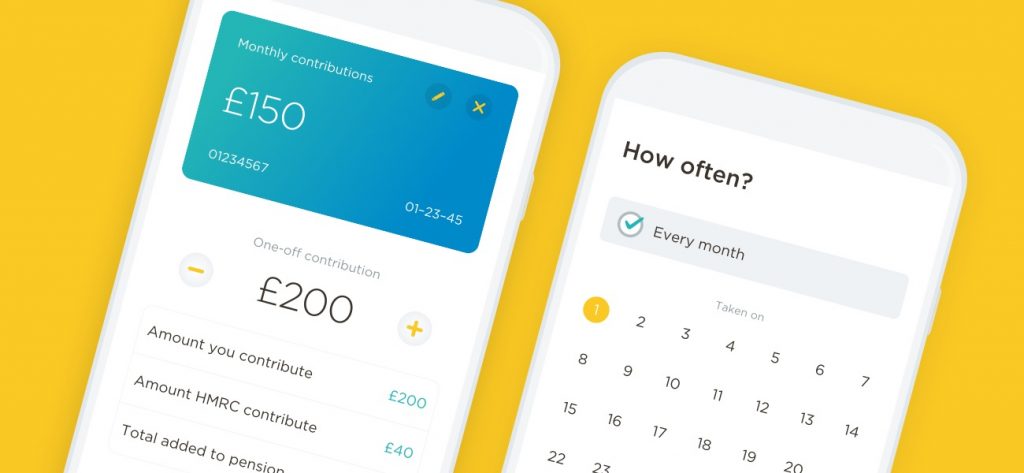

1. They help you create one combined pension (with real-time balances) that you can access any time, anywhere and on your favourite mobile device. This is empowering!

The app is easily accessible on Android and Apple phones and has a neat fingerprint authentication function.

You also get ongoing automated email alerts about the progress of your transfer, which is helpful.

2. Fees are low cost and fair as covered above.

3. Their support team called BeeKeepers are very helpful and offer true human support.

4. PensionBee is authorised and regulated by the Financial Conduct Authority (FCA). So they’ve been through the scrutiny.

5. You get 100% protection of the Financial Services Compensation Scheme (FSCS) with them if there was ever an issue with their money managers.

6. The underlying money managers (Black Rock, State Street, and L&G) are solid and established name with strong balance sheets.

7. You are able to see your PensionBee balances through Money Dashboard, a Free app we like. A great way to pull together your financial balances all in one place.

8. They teach you about pensions in a really simple way.

9. PensionBee is mission led.

They have created a truly helpful product and continue to be innovative and partner with companies for better customer experience.

In addition, they’re campaigners for important topics around switching costs and transparency.

What could be better about PensionBee?

1. Transfers of pensions from providers with paper-based (non-electronic) processes can cause delays to expected timelines.

Although this is not a PensionBee specific issue, it is one that could affect the experience with PensionBee and one that they continue to campaign about.

2. Although they are authorised and regulated by the FCA, they do not offer you Financial Advice.

You have to make your own decisions about your money ultimately, which is why you don’t pay high fees.

3. They can’t help you if you have a final salary pension. It has to be a Defined Contribution scheme.

4. The product only applies to your historic pensions and not your current pension with an employer.

You can transfer your current pension when you leave your employer.

Overall, the benefits of consolidating your pensions with far outweigh the possible costs.

Is PensionBee Safe?

As previously mentioned, the company is authorised and regulated by the FCA.

You also have 100% FSCS protection.

PensionBee as a company has received investment and continue to grow.

They are a going concern and have a strong balance sheet as a business (as at the date of this post), which you can see on Companies House.

Given they’re dealing with highly reputable managers such as BlackRock, State Street, and L&G, they will have been through extensive due diligence.

So the main risks such as credit and counterparty risk are less of an issue.

What do people say about PensionBee?

There are over 30,000 people currently using PensionBee.

The company has an overall “Excellent” 5-star review as can be seen on Trustpilot.

For a Financial Services company, this is highly unusual.

Feel free to have a read for yourself including any negative comments too.

Is PensionBee for you?

You should definitely explore PensionBee if you are looking to consolidate and make your pensions simpler.

If you prioritise ease of use, good performance as well as low cost then this is definitely one to look at seriously.

The digital revolution is here to make the things we can control easier, and PensionBee is well placed to make our pensions experience simpler.

Some final words…

Pensions are long term investments. As these are usually invested through the stock market across different asset classes, the value of your investment can go down and up.

Having easy access to them means that you’re more likely to look at how they’re performing more often.

The key thing to remember is that pensions need time to grow and the ease of access should be balanced with growth expectations over time.

Related Post:

- READER CASE STUDIES: When Can I Retire?

- Why Saving Money Should Be Prioritised Over Investing

- READER CASE STUDIES: What Should I Do With My Savings?

- 50+ Ways To Save Over £10,000 Every Year

Ever considered consolidating your pensions? If you have, what has been your experience?

Do please share this post if you found it useful, and remember, in all things be thankful and Seek Joy.