The Real Cost Of Raising A Child

Choosing to have kids or not is a pretty big topic for millennials right now.

When we considered starting a family, we ofcourse thought about the costs but decided to go ahead anyway.

I have friends who have chosen not to go down this path at all, and money is top of the list for why not to have kids.

This makes me wonder if our parents had a similar consideration about whether to bother with kids.

And had my parents chosen not to bother, I often wonder how things might have turned out.

Unlike my fellow millennials, I’ve kinda moved past the stage of considering whether I should have kids or not.

At the age of 30, I became a dad for the first time and we since followed that with another son and then stopped.

If my parents could have their way, we’d be on our third right now!

Rest assured, I’m fighting the resistance with the cost of having kids right at the top of my reasons to say NO (for now at least).

To be frank, I think it’s a real shame that many of my generation feel pretty stuck and many are deciding not to have kids because of the cost of raising them.

Interestingly, I’ve come across those who can have kids but have either ruled it out or sitting on the fence.

Then there are those that would absolutely love to have kids but sadly can’t for one reason or another.

Then there are those with 1 or 2 kids and who are considering whether they should have another or not due to broodiness or pressure from loved ones.

Whatever your circumstances are, chances are this is a topic that has either crossed your mind or remains a subject of discussion.

This post is part 1 of 2 and is followed by The Real Joy Of Raising A Child.

It might surprise you to know that although I’ve overall enjoyed my journey of fatherhood so far, I’ve aged too in a short period of time.

I can’t remember much of life before that blessed Mother’s day when our first son arrived.

I’ll be focusing on the day to day realities of parenthood on the next post.

For now, though, I’d like to explore the real cost of raising a child.

Typically when people talk about costs, they think of money only.

They also only think of the more obvious costs, and completely ignore what I’d like to call the ‘Additional costs of excitement or stupidity’ aka incidental costs of our choices.

An example of this is the need to move to say, a 4 bed home from a 2 bed flat as a result of deciding to have children.

We actually bought the house and moved in ahead of the children arriving… haha.

Please don’t make the same mistake!

Although it has worked out for us as it was actually a part of our 10-year plan, it took a relentless focus on our goals for mortgage freedom for this to work.

Hopefully, my point here is clear –

Decisions you make over a few glasses of red wine and sheer excitement have real (costly) consequences and often with no going back.

Hopefully, I haven’t put you off ‘cos we haven’t even looked at the numbers yet.

Cost of Money

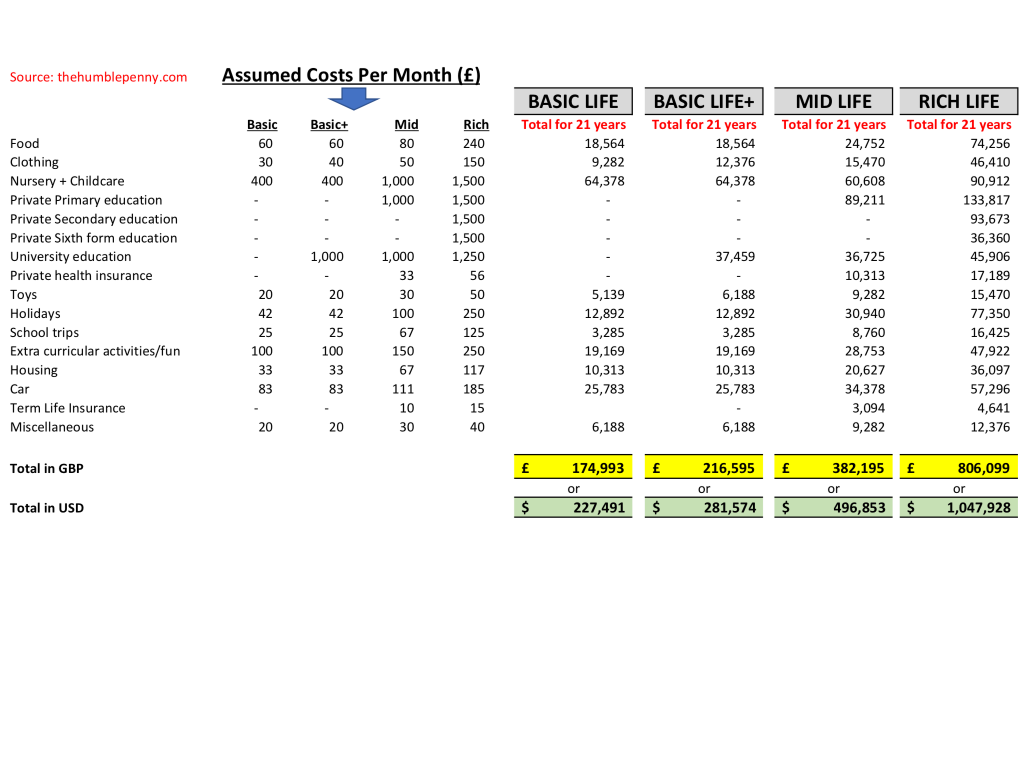

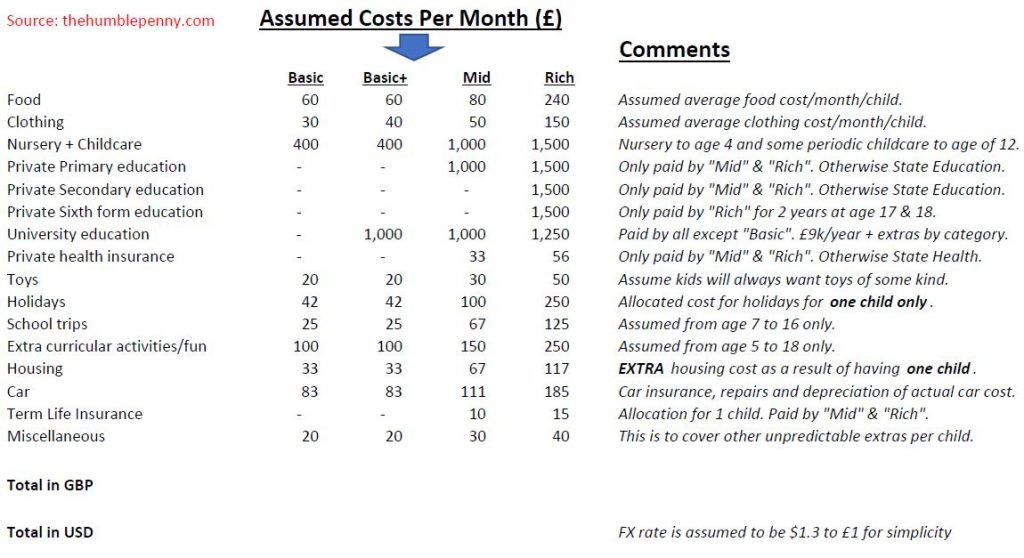

Let’s look at the typical costs of raising one child.

You can ofcourse then scale up for 2 or 3 kids although there are some savings to be had if you have kids of the same gender.

To work the numbers out, I’m going to keep things simple (this is meant to be fun) and make some basic assumptions:

- Life is assumed to be in the UK or similar country and near a major City.

- Costs for the first 21 years of life using 6 years actuals (from my parenthood so far) & 15 years forecast.

- 2% inflation is factored in.

- All figures are in GBP with USD equivalents.

Given kids can be raised at different costs, we’ll explore 4 possibilities

i) Basic Life

The cost of raising a child is the least here.

You rely on the State for education (Primary to Secondary), healthcare and your child doesn’t bother with University.

ii) Basic Life+

The cost of raising a child is the same as ‘Basic Life’ above except your child decides to go to University for 3 years.

iii) Mid Life

The cost of raising a child is a bit more expensive as you send your child to Private Primary Education and also to University.

You also pay for private health insurance to add to your State benefits and you have life insurance that also covers your child.

iv) Rich Life

The cost of raising a child is at the highest here.

Your child is exclusively privately educated all through and then also attend University.

You also pay for private health insurance to add to your State benefits and you have life insurance that also covers your child.

In addition, everything else is expensive from extracurricular activities to holidays and car costs as you likely drive brand new cars.

Below is a summary of the numbers for each scenario:

The immediate reaction to these numbers is likely one of shock and utterances of 4 letter words!

I’ve tried to keep them as realistic as possible and probably missed out on a few cost categories.

Note that the numbers are inflated by 2% every year, so the totals are the sum of future costs.

You’d have to discount backward to see the present value although, to be honest, they won’t be that different.

These numbers basically say that the cost of raising a child over time is not insignificant no matter what path you choose.

Note though that a huge factor here is location.

Someone raising a child in a remote town or village will ofcourse do it a lot cheaper.

However, in any case, there is money to be spent!

One way I try to look beyond the money problem is to see it as a time problem.

This removes the major focus on the numbers as one large figure and places it on how I can create the assets that will cover these costs over time.

Someone I met a long time ago referred to this as creating a ‘Money fountain’.

Another way I solve the money problem is to keep costs low and where possible, focus on the essentials.

Cost of Aspiration

Aspiration is a great thing. In fact, I’d say it’s necessary for pushing us out of our comfort zones.

However, it also comes at a cost.

Many people who haven’t quite attained in life typically want better education for their children because they see this as the possible path to success.

You also see this among ethnic minority or immigrant groups who are often playing catch up and aspire for success by investing in education.

One’s hope is that aspiration and the expensive decisions often taken to make them a reality will result in a high return on investment.

Whilst this could possibly be the case, there is usually a timing difference between the cost being incurred and the return being generated (if at all).

A case in point is the decision to invest in private education when there is a decent option of state education.

The former isn’t a necessity and should really only be pursued if one has the available resources.

Not necessarily because they can afford it today.

This is the type of misjudgment that many make when considering such decisions.

I know all about this because we’ve pursued this Private Education path for Primary school mainly because we could not get into a decent state primary school locally.

The other reason was to see what that quality of education is like… aka Aspiration.

To make it all happen, we saved for 4 years by not paying much towards nursery because we run a nursery business as a family.

As such, we’ve deferred the cost of nursery fees and now investing it in Primary education only.

This remains a choice and we would move to a State Primary if there ever became a need to do it.

We plan to do so for Secondary education anyhow.

Cost of Time

When you have kids, they’re your responsibility 24/7.

Well, that assumes that you’re a responsible and loving parent.

Where we used to have the option of getting back from work and possibly going out for dinner or watching a movie, those are somewhat gone.

Don’t get me wrong, there are days when our evening routine is seriously on point and the kids go to bed at 7.30pm.

However this is not always the case and the evenings essentially get dominated by activities like reading, writing, games, bath time etc.

Whilst these are great, they wipe out free time to do whatever and whenever!

So I don’t put you off completely, the time cost can be shared with your partner and even family members.

Some people even hire in help with au pairs and nannies.

The time cost also varies as time passes.

In the first 2 years of life, you may as well give up on the hope of sleep.

From 3 to 5, the focus shifts to routine and if you’re super efficient, you start to get some of your evenings back.

Although weekends remain a write-off.

From 5 – 10 the differences between boys and girls emerge even more and your time is decimated even more so by individual activities such as sports, music, tutoring etc.

Then 10 – 15 there is even more pressure from exams and so your time will be spent on emotional support and silencing outbursts although the kids will be more independent.

From 15 – 21 You’ll likely give up altogether and hand over mentoring to the godparents. Chances are they will still be living at home. You’ll most certainly see more of your time here.

In short, there is an inverse relationship between the decision to have kids and the amount of free time you have through life.

This is made worse if you’re mainly emotional (and/or careless) about the idea of having kids and end up with 3 or 4.

God help you!

Cost of Effort

Although the financial costs of raising a child are a cause for concern, I’m more concerned about the cost of effort.

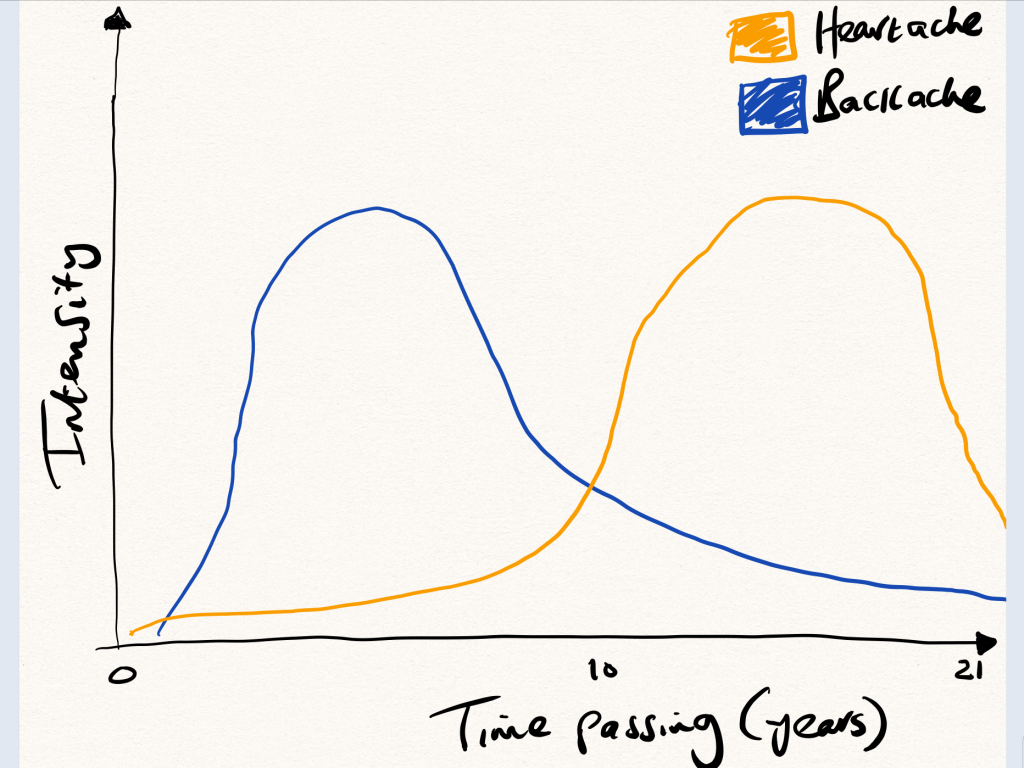

What I really mean here is the backache and heartache that comes with raising children.

This is stuff that wears you out daily and drains you emotionally.

In the beginning, the cost is felt on your back thanks to the day to day routines and activities tied to raising a child.

You feel this the most from the ages of 5 – 10 when children are most active.

Presumably down to spikes in hormones such as testosterone.

This is the stage of life where we’re at present and I can tell you the struggle is real.

Heartache vs Backache over time:

In the 5 -10 age zone, kids start to test your patience too.

This is the beginnings of the heartache that continue into the teenage years and adulthood.

Our sons now team up and play off against us as parents.

They know just how to irritate us through what they say or do and have become experts at pushing us to the edge.

I’ve found myself using my MBA negotiations training on my kids.

Of course, they smarten up and now understand some of our tactics.

I have even explored books such as Raising Boys as the way we were raised just doesn’t work today.

What’s frustrating about the effort needed is that it is relentless every day.

Whether you’re tired or not, you still need to wake up when your alarm goes off.

You wake them up, get them ready for the day and forget about the frustrations of the day before.

Learning to see this all as a continual work in progress is the right mindset.

Have no major expectations of your kids if you have any.

They’ll keep changing the game if you’re too rigid in your approach.

Cost to Relationships

As the first one among my group of friends to get married, it took some time for my then single friends to understand why life would never be the same again.

I couldn’t hang out with them as spontaneously as before and the chances of an all guys holiday became next to zero.

Having kids has a real cost to relationships. You’ll start to find yourself hanging out with friends with kids or making new friends with kids.

This ofcourse comes at a cost to your existing relationships and those without kids will never understand because they aren’t in your shoes.

Another way it affects your relationships is in your romantic situation with your partner or spouse.

Love life? What love life? Basically, slash all such activities in half at least.

The majority focus will be on your new bundles of joy not necessarily because it’s what you want to do but because it’s what you must do.

It is this lack of “fun” in some relationships that lead to people doing the unthinkable and possibly start looking outside their marriages.

It’s for this reason that our policy will always be – Marriage first, children second.

Cost of Opportunity

This is the most noticeable of all the possible costs of raising a child.

The opportunity cost is simply the missed opportunities you’ve let go as a result of your choice to have kids.

There is essentially a real trade-off that happens when making that decision.

Goals such as Financial Independence become harder to achieve depending on what your life choices are about things like education, location, home type etc.

Careers take a knock as mums, in particular, take years off to raise children and in many cases never return to work in the same way.

Dads (and breadwinner mums) take on more responsibility and pressure to keep things ticking along.

The opportunity costs are real and should not be overlooked when considering the costs of raising kids.

To conclude,

The natural response from reading the above is that having children is a disaster financially and much more.

However, I’d disagree with this and mainly see having children as what needs to happen as part of doing life.

Although you’d be richer potentially by not having kids, will you truly be richer in life?

I’d argue not.

No doubt you should consider what it will cost you to have children in whatever location you live.

However, it should not be the overriding factor and the costs should be seen as something that gets spread over a long period of time.

What I think is worth considering deeply is The Real Joy Of Raising A Child. Check it out!

Related posts:

- 6 Keys To A Good Relationship

- How To Get Your Kids Interested In Money Management

- 100 Things That Made My Year (2018)

- How To Achieve Goals With Your Partner

How has the cost of raising a child affected you? Has it stopped you having one?

Do please share this post if you found it useful, and remember, in all things be thankful and Seek Joy.